www.industryemea.com

04

'24

Written on Modified on

SEMICONDUCTOR MANUFACTURING: LATEST TRENDS AND FUTURE PROSPECTS

The semiconductor industry, just like any other field, is prone to undergoing periods of diversification and consolidation, whether through organic or inorganic growth – K.A. Gerardino.

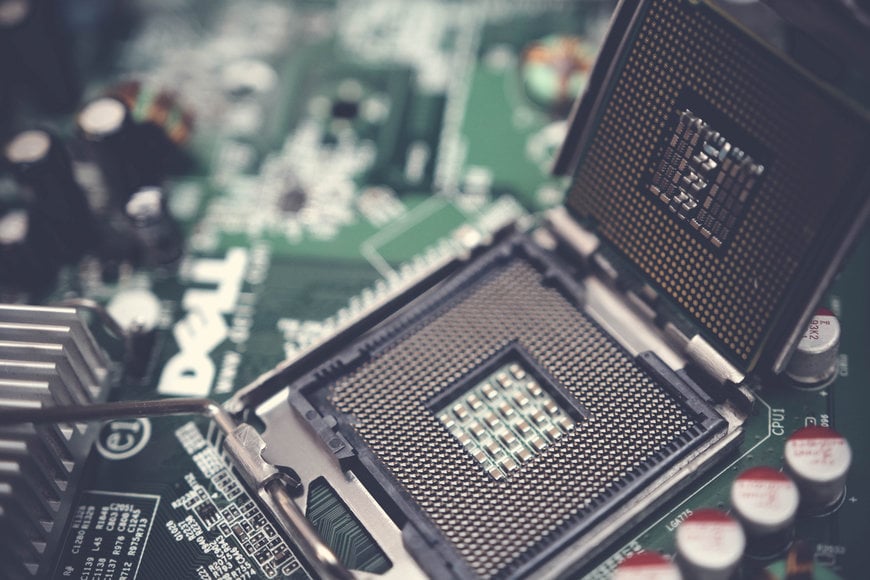

Image Courtesy of Blaz Erzetic

The global semiconductor revenue is projected to grow 16.8% in 2024 to total US$624 billion, according to the latest forecast from Gartner, Inc. This projection highlights the thriving future of the semiconductor industry. The semiconductor industry, just like any other field, is prone to undergoing periods of diversification and consolidation, whether through organic or inorganic growth. While major changes in the value chain may not occur often, we are of the opinion that the industry is presently going through a transformative phase.

Over the past four decades, the industry has undergone a significant transformation in response to the increasing need for substantial investments in manufacturing capabilities. This transformation has allowed semiconductor companies to enhance their operational profitability by focusing on specific technologies and application segments, as well as reducing the time required to bring innovative products to market.

Given the surging global demand for artificial intelligence (AI) and high-performance computing (HPC), along with the steady demand for smartphones, personal computers, infrastructure, and the resilient growth in the automotive sector, the semiconductor industry is poised to experience a fresh surge of growth. The semiconductor products encompass a wide range of offerings, including logic integrated circuits (IC), analog IC, microprocessor, and microcontroller IC, as well as memories.

Eight trends for the semiconductor market in 2024

The semiconductor market, renowned for its constant adaptation to evolving needs and demands across various applications, stands as one of the most dynamic and innovative sectors globally. International Data Corp.'s latest research and analysis have identified eight trends that will significantly influence the semiconductor industry in 2024.

1. The semiconductor sales market is projected to experience a recovery in 2024, exhibiting an annual growth rate of 20%. Despite sporadic short orders and rush orders in the latter half of 2023, the initial decline of 20% in the first half of the year makes it challenging to reverse the trend. Consequently, the semiconductor sales market is anticipated to decline by 12% in 2023. However, in 2024, the reduction in production and the subsequent increase in product prices, along with the growing adoption of high-priced HBM, are expected to stimulate market growth. The gradual rebound in smartphone demand and the strong need for AI chips further support IDC's prediction of a return to growth in the semiconductor market in 2024, with an annual growth rate surpassing 20%.

2. The automotive market has shown resilience in its growth, but the future of the semiconductor market lies in the advancement of automotive intelligence and electrification. The ADAS sector is projected to have the highest growth rate, with a CAGR of 19.8% by 2027, making up 30% of the automotive semiconductor market in that year. Following closely is the Infotainment sector, expected to have a CAGR of 14.6% by 2027, accounting for 20% of the market in that year. This growth is driven by the increasing integration of automotive intelligence and connectivity. As a result, the demand for semiconductors in the automotive industry will continue to be steady and long-term.

3. The proliferation of AI applications is expanding beyond data centers and reaching personal devices. This is primarily due to the increasing need for higher computing power, data processing capabilities, complex language models, and big data analytics in data centers. Thanks to the advancements in semiconductor technology, it is projected that starting in 2024, personal devices such as smartphones, PCs, and wearable devices will incorporate AI functionalities. As a result, the market will witness a gradual release of AI-powered personal devices. The introduction of AI is expected to pave the way for more innovative applications in personal devices, consequently driving the demand for semiconductors and advanced packaging.

4. The Asia-Pacific market for IC design is projected to experience a 14% growth by 2024, signaling the end of the depletion of inventory. Despite the challenges faced in 2023 due to inventory rationalization, IC designers in the region displayed resilience and actively invested in innovation to maintain their relevance in the supply chain. Furthermore, these designers have been leveraging AI adoption in client devices and automotive sectors to cultivate new technologies. As the global personal device market gradually recovers, new growth opportunities are expected to emerge, contributing to the estimated annual market growth of 14% in 2024.

5. The foundry industry has experienced a decline in capacity utilization rates, particularly for mature processes technologies above 28nm, due to inventory correction and weak demand. However, there has been a gradual recovery in the second half of 2023, driven by increased demand for consumer electronics and AI. The most notable recovery has been observed in advanced processes. Moving forward to 2024, the combined efforts of TSMC, Samsung, and Intel, along with the stabilization of end-user demand, are expected to contribute to the continued growth of the global semiconductor foundry industry. It is anticipated that the industry will achieve double-digit growth next year.

6. China's production capacity has been growing rapidly, driven by the U.S. ban. In order to maintain high utilization rates, the Chinese industry has been offering competitive pricing, which is anticipated to create challenges for non-Chinese foundries. Furthermore, the need to destock industrial control and automotive IC inventory in the near future will add to the pressure on suppliers, as wafer production is mainly focused on mature processes. This situation will further impact their ability to regain bargaining power.

7. The semiconductor industry is witnessing a growing demand for advanced packaging technologies due to the constant improvement in functionality and performance requirements of semiconductor chips. Over the period from 2023 to 2028, the 2.5/3D packaging market is projected to experience a Compound Annual Growth Rate (CAGR) of 22%. This significant growth rate highlights the increasing significance of this market segment in the semiconductor package testing market.

8. The expansion of CoWoS supply chain capacity is set to enhance the availability of AI chips, driven by the growing demand for servers in the era of artificial intelligence. Despite the current 20% gap between supply and demand for CoWoS, both NVIDIA and international IC design houses are ramping up their orders. Projections indicate that CoWoS capacity will witness a remarkable 130% increase by the second half of 2024. This surge in capacity will attract more vendors to actively participate in the CoWoS supply chain, ultimately bolstering the supply of AI chips in 2024. Consequently, this development will serve as a significant catalyst for the widespread adoption and advancement of AI technology.

Largest Semiconductor Companies in the World

Understanding the trends and innovations in the semiconductor industry, which serves as the foundation of the technology sector, becomes easier when one is aware of the largest semiconductor companies worldwide. These companies not only engage in the design, manufacturing, testing, and packaging of integrated circuits, but also play a crucial role in powering countless devices. By closely monitoring the activities and achievements of these major semiconductor companies, one can gain valuable insights into the present and future state of this essential and dynamic industry. Here are a few of the biggest semiconductor companies globally, outlining their offerings and solutions.

Taiwan Semiconductor Manufacturing Co. (TSMC) is the world's largest semiconductor foundry, the industry term for contract manufacturing of semiconductors on behalf of customers. Pure-play foundries manufacture integrated circuits on behalf of clients. Many semiconductor companies outsource the manufacturing of their chips to Taiwan Semi.

Intel primarily develops processors for the personal computer (PC) and enterprise server markets. Its Client Computing Group segment supplying PC processors and Data Center Group segment serving enterprise customers including cloud services providers are its largest divisions. The remainder consists of internet-of-things (IoT) solutions for retail, industrial, and healthcare markets; memory and storage products; autonomous driving technology; and programmable semiconductors. The company produces motherboard chipsets, network interface controllers, and integrated circuits. In 2021, Intel unveiled a plan to invest aggressively in expanding its foundry business, including in the U.S.

Qualcomm is a global semiconductor and telecommunications company that designs and markets wireless communications products and services. Telecommunications companies worldwide use Qualcomm's patented CDMA (code division multiple access) technology, which has played an integral role in the development of wireless communications. Its Snapdragon chipsets are found in many mobile devices.

Broadcom supplies digital and analog semiconductors as well as software for networking, telecom, and data center markets. It provides interfaces for computers' Bluetooth connectivity, routers, switches, processors, and fiber optics.

Micron Technology supplies memory chips including NAND flash products as well as rewritable disc storage solutions. Its products are used in computers, consumer electronics, automobiles, communications, and servers.

Nvidia is a leading developer of graphics processors for personal computers and enterprise servers. These graphics processing units, or GPUs, provide high-end performance sought by cryptocurrency miners, computer gamers, and those who work with computer-aided design.

Applied Materials is a leading supplier of capital equipment used to manufacture semiconductors as well as liquid crystal display (LCD) screens. The company's technology is used to produce high-quality silicon wafers and to deposit microscopic circuitry on their surfaces.

ASE Technology is a Taiwan-based holding company that provides semiconductor assembly, packaging, and testing services. The company was created by the combination of Advanced Semiconductor Engineering Inc. and Siliconware Precision Industries Co., Ltd.

Advanced Micro Devices, Inc. (AMD) is a multinational semiconductor company that designs and manufactures microprocessors, graphics processing units (GPUs), and other computer hardware components. AMD is a leading supplier of microprocessors for personal computers and servers, and its products are used in a wide variety of devices including desktop and laptop computers, game consoles, and cloud and enterprise servers. In addition to its core microprocessor and GPU businesses, AMD also offers a range of other products and technologies, including software, memory, and networking solutions.

Based in the Netherlands, ASML is a leading supplier of advanced lithography systems used by chip manufacturers to add circuitry to silicon wafers. Its machines help chip makers use costly wafers as efficiently as possible and to improve the performance of their chips.

The technology sector heavily relies on the semiconductor industry as its foundation. This is primarily because every electronic device, ranging from a compact Juul to a colossal supercomputer, necessitates a processor to operate efficiently. However, the production of semiconductors, particularly for advanced technological devices, is limited to a handful of prominent corporations. Consequently, this results in a scarcity of supply and an overwhelming demand for these components.

At the same time, chipmakers are not the only semiconductor companies. The entire ecosystem is made up of countless firms, that range from those that provide the tools to design chips, to those that supply essential raw materials and chemicals for preparing silicon for its journey inside the massive manufacturing machines, and the suppliers of the machines themselves. Then, more firms are responsible for providing quality control testing equipment as well as packaging the chips inside boards that enable them to power up computers and other devices. This is not to mention that while all these firms are responsible for making the chips, their services wouldn't be required if it weren't for designers such as AMD and NVIDIA, who are responsible for generating demand in the chipmaking sector by creating new product blueprints.

Hence, it is evident that the chipmaking sector stands out as an exceptionally diverse industry, distinct from many others, due to its significant reliance on geographically isolated supply chain connections. For instance, TSMC carries out the majority of its chip production in Taiwan. However, the industry that supports TSMC in manufacturing these chips, namely the design and quality equipment firms mentioned earlier, is predominantly situated in the United States, resulting in a substantial geographical gap.

In spite of these challenges, the semiconductor sector is anticipated to experience significant expansion in the upcoming years. Numerous research studies suggest that the value of the semiconductor industry could surpass US$1 trillion in the near future.

The semiconductor industry cannot be discussed without acknowledging Intel, the leading chipmaker in terms of production output. Despite falling behind TSMC in chip manufacturing technology, Intel is actively constructing multiple new chipmaking facilities while navigating a challenging macroeconomic climate. Moreover, there are claims that the company has flooded the market with products solely to maintain its presence on retail shelves.

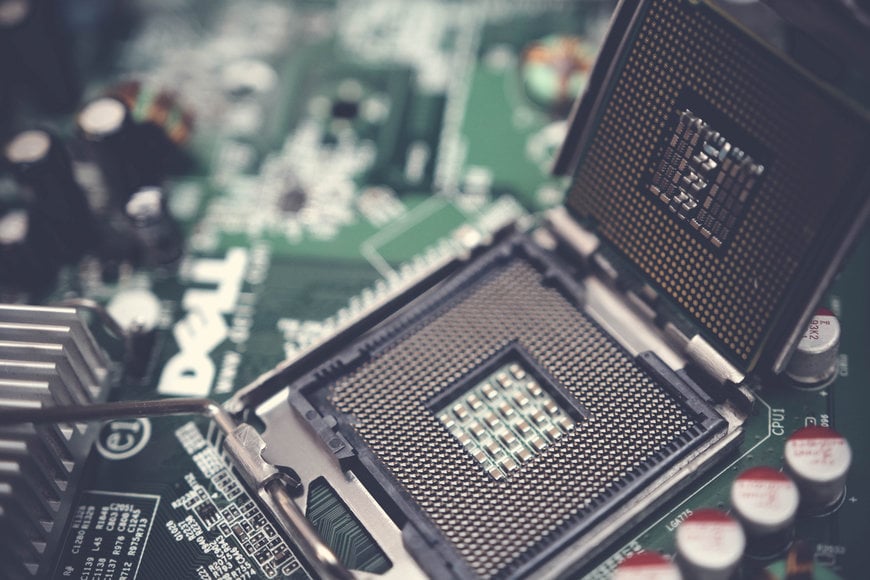

Image Courtesy of Pok Rie

Outsourced semiconductor assembly and testing

Outsourced semiconductor assembly and testing (OSAT) serves as a crucial link connecting semiconductor foundries and end-users. It plays a crucial role in ensuring the final quality and efficiency of chips, making it a vital component of the semiconductor industry chain.

OSAT vendors are essential in the execution of testing, packaging, and assembly for integrated circuit devices, thereby enhancing the overall performance, functionality, and reliability of electronic products. Additionally, OSAT provides a cost-efficient and innovative solution that enables electronic devices to improve processing speeds, utility, and connectivity, all while occupying minimal space.

The prospects of OSAT are promising, as the global market is expected to grow by 7.3% annually from 2020 to 2026, reaching US$49.71 billion2. The main drivers of this growth are the increased demand from the automotive sector and IoT (Internet of Things) connected devices, as well as the introduction of 5G technology. OSAT providers will also benefit from the trend of advanced and complex chip packaging and testing, such as chiplets, 3D stacking, and heterogeneous integration technologies2. However, OSAT also faces some challenges, such as capacity constraints, trade tensions, and technology transitions, that require more collaboration and innovation among the industry players.

As the evolution of technologies like HPC, AI, and Machine Learning progresses, there is an anticipated transition towards advanced packaging that involves heterogeneous integration, moving from 2D to 2.5D/3D structures, in alignment with Moore's law. In the future, manufacturers are expected to enhance their investments to cater to the expanding market demand.

Among the top 10 OSAT vendors worldwide, six are based in Taiwan, three in China, and one in the United States. Together, these vendors hold a total market share of 80.1%. In Taiwan, the vendors include ASE, PTI, KYEC, Chipbond, ChipMOS, and Sigurd. In China, the vendors are JCET, TFME, and Hua Tian. The United States is represented by Amkor.

The Asia/Pacific region is home to nine of the top 10 OSAT vendors, highlighting its significant role in the global OSAT industry. The regional dynamics from 2021 to 2022 reveal that the market shares of vendors in Taiwan decreased by 2.5% to 49.1%. This decline was influenced by the sudden drop in demand for driver integrated circuits (IC), memory, and mid-range to low-end mobile phone chip packaging capacity.

In China, OSAT plants continued to expand in line with the government's semiconductor domestication policy. Coupled with the increasing sales of AMD, a major IC design manufacturer that collaborates with TFME, the market shares of local vendors in China increased by 1.0% to 26.3%.

In the United States, Amkor, the largest vendor for automotive OSAT, saw its market share rise by 1.7% to 18.8%. This growth can be attributed to the increased demand for chips in industries such as automobiles and 5G high-end/flagship mobile phones. Vendors in other regions also experienced growth, but the specific details were not provided.

Moving forward

The semiconductor manufacturing industry is currently facing numerous challenges, including the global chip shortage, the growing complexity of designs, the talent gap, disruptions in the supply chain, and competition from new players. To address these challenges, several potential solutions have been identified:

1. Enhancing the capacity and resilience of semiconductor fabs: This can be achieved by constructing new fabs in strategic locations, expanding existing facilities, investing in advanced equipment and technologies, diversifying the sources of raw materials and components, and fostering collaborations with other stakeholders in the ecosystem.

2. Prioritizing innovation and differentiation: This approach involves exploring new opportunities in emerging markets and applications, such as artificial intelligence, 5G, cloud computing, and the Internet of Things. Additionally, it entails developing novel capabilities and products that go beyond traditional node size reduction, such as 3D integration, heterogeneous integration, and innovative materials.

3. Strengthening the talent pipeline and retention: This strategy focuses on increasing the number and diversity of students pursuing education in semiconductor-related fields, facilitating their transition into the industry, and establishing clear career development paths for them. Furthermore, it improving diversity, equity, and inclusion efforts and addressing the underlying causes of attrition within the industry.

4. Promoting collaboration within the semiconductor ecosystem: This entails forming strategic partnerships and alliances with other semiconductor companies, suppliers, customers, governments, academia, and research institutions. It also involves sharing best practices, resources, and information, as well as actively participating in industry associations and standards bodies.

By implementing these solutions, the semiconductor manufacturing industry can effectively tackle its challenges and pave the way for future growth and success.

The global semiconductor revenue is projected to grow 16.8% in 2024 to total US$624 billion, according to the latest forecast from Gartner, Inc. This projection highlights the thriving future of the semiconductor industry. The semiconductor industry, just like any other field, is prone to undergoing periods of diversification and consolidation, whether through organic or inorganic growth. While major changes in the value chain may not occur often, we are of the opinion that the industry is presently going through a transformative phase.

Over the past four decades, the industry has undergone a significant transformation in response to the increasing need for substantial investments in manufacturing capabilities. This transformation has allowed semiconductor companies to enhance their operational profitability by focusing on specific technologies and application segments, as well as reducing the time required to bring innovative products to market.

Given the surging global demand for artificial intelligence (AI) and high-performance computing (HPC), along with the steady demand for smartphones, personal computers, infrastructure, and the resilient growth in the automotive sector, the semiconductor industry is poised to experience a fresh surge of growth. The semiconductor products encompass a wide range of offerings, including logic integrated circuits (IC), analog IC, microprocessor, and microcontroller IC, as well as memories.

Eight trends for the semiconductor market in 2024

The semiconductor market, renowned for its constant adaptation to evolving needs and demands across various applications, stands as one of the most dynamic and innovative sectors globally. International Data Corp.'s latest research and analysis have identified eight trends that will significantly influence the semiconductor industry in 2024.

1. The semiconductor sales market is projected to experience a recovery in 2024, exhibiting an annual growth rate of 20%. Despite sporadic short orders and rush orders in the latter half of 2023, the initial decline of 20% in the first half of the year makes it challenging to reverse the trend. Consequently, the semiconductor sales market is anticipated to decline by 12% in 2023. However, in 2024, the reduction in production and the subsequent increase in product prices, along with the growing adoption of high-priced HBM, are expected to stimulate market growth. The gradual rebound in smartphone demand and the strong need for AI chips further support IDC's prediction of a return to growth in the semiconductor market in 2024, with an annual growth rate surpassing 20%.

2. The automotive market has shown resilience in its growth, but the future of the semiconductor market lies in the advancement of automotive intelligence and electrification. The ADAS sector is projected to have the highest growth rate, with a CAGR of 19.8% by 2027, making up 30% of the automotive semiconductor market in that year. Following closely is the Infotainment sector, expected to have a CAGR of 14.6% by 2027, accounting for 20% of the market in that year. This growth is driven by the increasing integration of automotive intelligence and connectivity. As a result, the demand for semiconductors in the automotive industry will continue to be steady and long-term.

3. The proliferation of AI applications is expanding beyond data centers and reaching personal devices. This is primarily due to the increasing need for higher computing power, data processing capabilities, complex language models, and big data analytics in data centers. Thanks to the advancements in semiconductor technology, it is projected that starting in 2024, personal devices such as smartphones, PCs, and wearable devices will incorporate AI functionalities. As a result, the market will witness a gradual release of AI-powered personal devices. The introduction of AI is expected to pave the way for more innovative applications in personal devices, consequently driving the demand for semiconductors and advanced packaging.

4. The Asia-Pacific market for IC design is projected to experience a 14% growth by 2024, signaling the end of the depletion of inventory. Despite the challenges faced in 2023 due to inventory rationalization, IC designers in the region displayed resilience and actively invested in innovation to maintain their relevance in the supply chain. Furthermore, these designers have been leveraging AI adoption in client devices and automotive sectors to cultivate new technologies. As the global personal device market gradually recovers, new growth opportunities are expected to emerge, contributing to the estimated annual market growth of 14% in 2024.

5. The foundry industry has experienced a decline in capacity utilization rates, particularly for mature processes technologies above 28nm, due to inventory correction and weak demand. However, there has been a gradual recovery in the second half of 2023, driven by increased demand for consumer electronics and AI. The most notable recovery has been observed in advanced processes. Moving forward to 2024, the combined efforts of TSMC, Samsung, and Intel, along with the stabilization of end-user demand, are expected to contribute to the continued growth of the global semiconductor foundry industry. It is anticipated that the industry will achieve double-digit growth next year.

6. China's production capacity has been growing rapidly, driven by the U.S. ban. In order to maintain high utilization rates, the Chinese industry has been offering competitive pricing, which is anticipated to create challenges for non-Chinese foundries. Furthermore, the need to destock industrial control and automotive IC inventory in the near future will add to the pressure on suppliers, as wafer production is mainly focused on mature processes. This situation will further impact their ability to regain bargaining power.

7. The semiconductor industry is witnessing a growing demand for advanced packaging technologies due to the constant improvement in functionality and performance requirements of semiconductor chips. Over the period from 2023 to 2028, the 2.5/3D packaging market is projected to experience a Compound Annual Growth Rate (CAGR) of 22%. This significant growth rate highlights the increasing significance of this market segment in the semiconductor package testing market.

8. The expansion of CoWoS supply chain capacity is set to enhance the availability of AI chips, driven by the growing demand for servers in the era of artificial intelligence. Despite the current 20% gap between supply and demand for CoWoS, both NVIDIA and international IC design houses are ramping up their orders. Projections indicate that CoWoS capacity will witness a remarkable 130% increase by the second half of 2024. This surge in capacity will attract more vendors to actively participate in the CoWoS supply chain, ultimately bolstering the supply of AI chips in 2024. Consequently, this development will serve as a significant catalyst for the widespread adoption and advancement of AI technology.

Largest Semiconductor Companies in the World

Understanding the trends and innovations in the semiconductor industry, which serves as the foundation of the technology sector, becomes easier when one is aware of the largest semiconductor companies worldwide. These companies not only engage in the design, manufacturing, testing, and packaging of integrated circuits, but also play a crucial role in powering countless devices. By closely monitoring the activities and achievements of these major semiconductor companies, one can gain valuable insights into the present and future state of this essential and dynamic industry. Here are a few of the biggest semiconductor companies globally, outlining their offerings and solutions.

Taiwan Semiconductor Manufacturing Co. (TSMC) is the world's largest semiconductor foundry, the industry term for contract manufacturing of semiconductors on behalf of customers. Pure-play foundries manufacture integrated circuits on behalf of clients. Many semiconductor companies outsource the manufacturing of their chips to Taiwan Semi.

Intel primarily develops processors for the personal computer (PC) and enterprise server markets. Its Client Computing Group segment supplying PC processors and Data Center Group segment serving enterprise customers including cloud services providers are its largest divisions. The remainder consists of internet-of-things (IoT) solutions for retail, industrial, and healthcare markets; memory and storage products; autonomous driving technology; and programmable semiconductors. The company produces motherboard chipsets, network interface controllers, and integrated circuits. In 2021, Intel unveiled a plan to invest aggressively in expanding its foundry business, including in the U.S.

Qualcomm is a global semiconductor and telecommunications company that designs and markets wireless communications products and services. Telecommunications companies worldwide use Qualcomm's patented CDMA (code division multiple access) technology, which has played an integral role in the development of wireless communications. Its Snapdragon chipsets are found in many mobile devices.

Broadcom supplies digital and analog semiconductors as well as software for networking, telecom, and data center markets. It provides interfaces for computers' Bluetooth connectivity, routers, switches, processors, and fiber optics.

Micron Technology supplies memory chips including NAND flash products as well as rewritable disc storage solutions. Its products are used in computers, consumer electronics, automobiles, communications, and servers.

Nvidia is a leading developer of graphics processors for personal computers and enterprise servers. These graphics processing units, or GPUs, provide high-end performance sought by cryptocurrency miners, computer gamers, and those who work with computer-aided design.

Applied Materials is a leading supplier of capital equipment used to manufacture semiconductors as well as liquid crystal display (LCD) screens. The company's technology is used to produce high-quality silicon wafers and to deposit microscopic circuitry on their surfaces.

ASE Technology is a Taiwan-based holding company that provides semiconductor assembly, packaging, and testing services. The company was created by the combination of Advanced Semiconductor Engineering Inc. and Siliconware Precision Industries Co., Ltd.

Advanced Micro Devices, Inc. (AMD) is a multinational semiconductor company that designs and manufactures microprocessors, graphics processing units (GPUs), and other computer hardware components. AMD is a leading supplier of microprocessors for personal computers and servers, and its products are used in a wide variety of devices including desktop and laptop computers, game consoles, and cloud and enterprise servers. In addition to its core microprocessor and GPU businesses, AMD also offers a range of other products and technologies, including software, memory, and networking solutions.

Based in the Netherlands, ASML is a leading supplier of advanced lithography systems used by chip manufacturers to add circuitry to silicon wafers. Its machines help chip makers use costly wafers as efficiently as possible and to improve the performance of their chips.

The technology sector heavily relies on the semiconductor industry as its foundation. This is primarily because every electronic device, ranging from a compact Juul to a colossal supercomputer, necessitates a processor to operate efficiently. However, the production of semiconductors, particularly for advanced technological devices, is limited to a handful of prominent corporations. Consequently, this results in a scarcity of supply and an overwhelming demand for these components.

At the same time, chipmakers are not the only semiconductor companies. The entire ecosystem is made up of countless firms, that range from those that provide the tools to design chips, to those that supply essential raw materials and chemicals for preparing silicon for its journey inside the massive manufacturing machines, and the suppliers of the machines themselves. Then, more firms are responsible for providing quality control testing equipment as well as packaging the chips inside boards that enable them to power up computers and other devices. This is not to mention that while all these firms are responsible for making the chips, their services wouldn't be required if it weren't for designers such as AMD and NVIDIA, who are responsible for generating demand in the chipmaking sector by creating new product blueprints.

Hence, it is evident that the chipmaking sector stands out as an exceptionally diverse industry, distinct from many others, due to its significant reliance on geographically isolated supply chain connections. For instance, TSMC carries out the majority of its chip production in Taiwan. However, the industry that supports TSMC in manufacturing these chips, namely the design and quality equipment firms mentioned earlier, is predominantly situated in the United States, resulting in a substantial geographical gap.

In spite of these challenges, the semiconductor sector is anticipated to experience significant expansion in the upcoming years. Numerous research studies suggest that the value of the semiconductor industry could surpass US$1 trillion in the near future.

The semiconductor industry cannot be discussed without acknowledging Intel, the leading chipmaker in terms of production output. Despite falling behind TSMC in chip manufacturing technology, Intel is actively constructing multiple new chipmaking facilities while navigating a challenging macroeconomic climate. Moreover, there are claims that the company has flooded the market with products solely to maintain its presence on retail shelves.

Image Courtesy of Pok Rie

Outsourced semiconductor assembly and testing

Outsourced semiconductor assembly and testing (OSAT) serves as a crucial link connecting semiconductor foundries and end-users. It plays a crucial role in ensuring the final quality and efficiency of chips, making it a vital component of the semiconductor industry chain.

OSAT vendors are essential in the execution of testing, packaging, and assembly for integrated circuit devices, thereby enhancing the overall performance, functionality, and reliability of electronic products. Additionally, OSAT provides a cost-efficient and innovative solution that enables electronic devices to improve processing speeds, utility, and connectivity, all while occupying minimal space.

The prospects of OSAT are promising, as the global market is expected to grow by 7.3% annually from 2020 to 2026, reaching US$49.71 billion2. The main drivers of this growth are the increased demand from the automotive sector and IoT (Internet of Things) connected devices, as well as the introduction of 5G technology. OSAT providers will also benefit from the trend of advanced and complex chip packaging and testing, such as chiplets, 3D stacking, and heterogeneous integration technologies2. However, OSAT also faces some challenges, such as capacity constraints, trade tensions, and technology transitions, that require more collaboration and innovation among the industry players.

As the evolution of technologies like HPC, AI, and Machine Learning progresses, there is an anticipated transition towards advanced packaging that involves heterogeneous integration, moving from 2D to 2.5D/3D structures, in alignment with Moore's law. In the future, manufacturers are expected to enhance their investments to cater to the expanding market demand.

Among the top 10 OSAT vendors worldwide, six are based in Taiwan, three in China, and one in the United States. Together, these vendors hold a total market share of 80.1%. In Taiwan, the vendors include ASE, PTI, KYEC, Chipbond, ChipMOS, and Sigurd. In China, the vendors are JCET, TFME, and Hua Tian. The United States is represented by Amkor.

The Asia/Pacific region is home to nine of the top 10 OSAT vendors, highlighting its significant role in the global OSAT industry. The regional dynamics from 2021 to 2022 reveal that the market shares of vendors in Taiwan decreased by 2.5% to 49.1%. This decline was influenced by the sudden drop in demand for driver integrated circuits (IC), memory, and mid-range to low-end mobile phone chip packaging capacity.

In China, OSAT plants continued to expand in line with the government's semiconductor domestication policy. Coupled with the increasing sales of AMD, a major IC design manufacturer that collaborates with TFME, the market shares of local vendors in China increased by 1.0% to 26.3%.

In the United States, Amkor, the largest vendor for automotive OSAT, saw its market share rise by 1.7% to 18.8%. This growth can be attributed to the increased demand for chips in industries such as automobiles and 5G high-end/flagship mobile phones. Vendors in other regions also experienced growth, but the specific details were not provided.

Moving forward

The semiconductor manufacturing industry is currently facing numerous challenges, including the global chip shortage, the growing complexity of designs, the talent gap, disruptions in the supply chain, and competition from new players. To address these challenges, several potential solutions have been identified:

1. Enhancing the capacity and resilience of semiconductor fabs: This can be achieved by constructing new fabs in strategic locations, expanding existing facilities, investing in advanced equipment and technologies, diversifying the sources of raw materials and components, and fostering collaborations with other stakeholders in the ecosystem.

2. Prioritizing innovation and differentiation: This approach involves exploring new opportunities in emerging markets and applications, such as artificial intelligence, 5G, cloud computing, and the Internet of Things. Additionally, it entails developing novel capabilities and products that go beyond traditional node size reduction, such as 3D integration, heterogeneous integration, and innovative materials.

3. Strengthening the talent pipeline and retention: This strategy focuses on increasing the number and diversity of students pursuing education in semiconductor-related fields, facilitating their transition into the industry, and establishing clear career development paths for them. Furthermore, it improving diversity, equity, and inclusion efforts and addressing the underlying causes of attrition within the industry.

4. Promoting collaboration within the semiconductor ecosystem: This entails forming strategic partnerships and alliances with other semiconductor companies, suppliers, customers, governments, academia, and research institutions. It also involves sharing best practices, resources, and information, as well as actively participating in industry associations and standards bodies.

By implementing these solutions, the semiconductor manufacturing industry can effectively tackle its challenges and pave the way for future growth and success.