www.industryemea.com

25

'23

Written on Modified on

LITHIUM-ION BATTERY RECYCLING: PROCESSES, LATEST TRENDS, & CHALLENGES

K.A. Gerardino discusses the processes, current trends, and pressing challenges in the field of lithium-ion battery recycling, shedding light on the sustainable future of this technology.

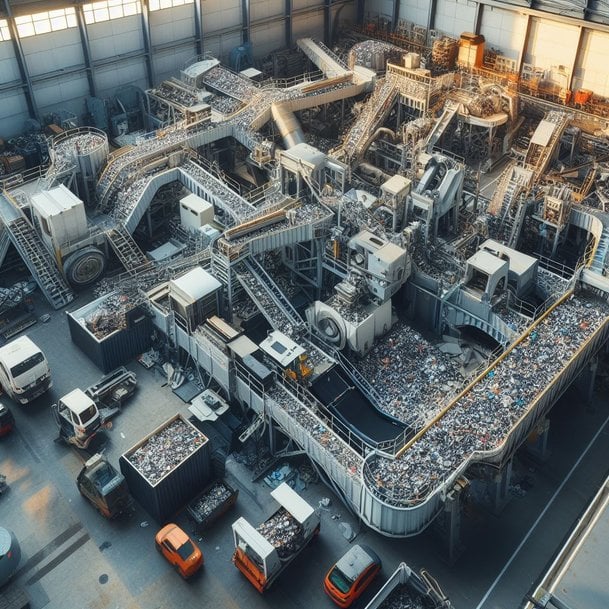

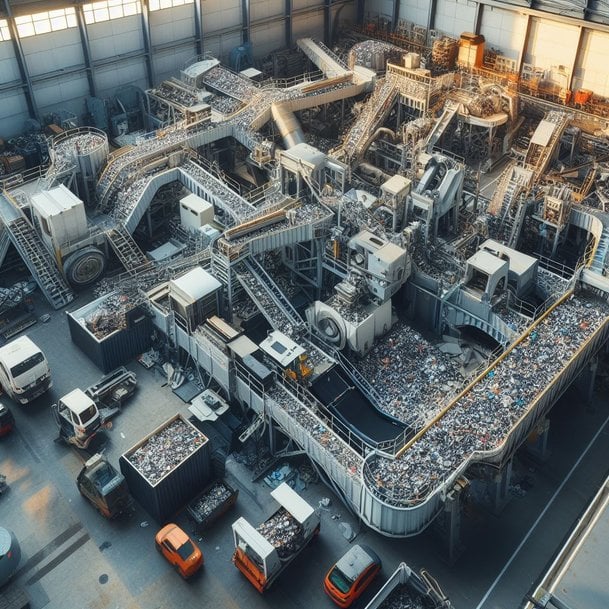

Lithium-ion batteries being fed to the shredder (Image courtesy of Li-Cycle Corp.)

Batteries play a substantial role in providing a reliable power source to facilitate daily operations in a wide range of applications, such as smartphones, laptops, electric vehicles, and renewable energy systems. Lithium-ion is one example of a widely used battery due to its many advantages, for instance, high energy density, long lifespan, and low self-discharge rate.

But did you know that millions of batteries end up in landfills every year, where they leak toxic chemicals and harm the environment? Yes, batteries contain harmful chemicals that can pollute the soil and water. By recycling them, you can keep these toxins out of the environment and protect your health. In fact, the market value of lithium-ion battery recycling worldwide is forecast to grow with a compound annual growth rate (CAGR) of more than 20 percent in the coming decade, reaching US$35.1 billion in 2031, according to Fortune Business Insights.

Aside from pollution, these batteries also pose social challenges, such as resource depletion, pollution, and safety hazards. Therefore, recycling lithium-ion batteries is not only a necessity, but also an opportunity to create a more sustainable and circular economy. In fact, industry sources see battery recycling as one of the top ten breakthroughs in 2023.

In this report, we will explore the current status, trends, challenges, and prospects of the lithium-ion battery recycling industry, and provide recommendations for its future development.

Battery Recycling: A Breakthrough Technology

Recycling batteries is not only a duty, but also an opportunity to create a more sustainable and circular economy. However, many people might not be aware of the benefits of recycling batteries for themselves and the planet.

Battery recycling can help reduce the environmental and social costs of battery production and disposal, such as greenhouse gas emissions, water pollution, land degradation, and human rights violations. It can increase the supply and availability of critical metals like lithium, cobalt, and nickel, which are essential for making batteries for electric vehicles, smartphones, laptops, and other devices. These metals are scarce, expensive, and geopolitically sensitive.

Remanufacturing can improve the performance and lifespan of batteries by recovering high-quality materials and preventing degradation. This can make batteries more efficient, reliable, and durable. Moreover, battery recycling can create new business opportunities and jobs in the circular economy, where waste is minimized and resources are reused. This can also foster innovation and collaboration among different stakeholders in the battery value chain.

However, there are also some challenges and limitations that need to be overcome. Battery recycling is still a complex and costly process that requires advanced technologies and methods to separate and purify the metals from the battery waste. The recovery rates and efficiencies vary depending on the type and condition of the battery.

Battery recycling is still not widely adopted or supported by consumers, manufacturers, regulators, or investors. There are many barriers and gaps that hinder the development and deployment of battery recycling, such as lack of awareness, incentives, standards, infrastructure, or policies.

Battery recycling is not a silver bullet that can solve all the problems related to battery production and consumption. There are still other aspects that need to be addressed, such as improving battery design, reducing battery demand, increasing battery reuse or refurbishment, or finding alternative materials or sources.

Drivers that Define Market Scenarios

There are a few market scenarios that influence the performance and behaviour of the lithium-ion market over time. To understand how different market scenarios might unfold in the future, it is important to identify and analyse the drivers that shape them. Akihito Fujita, a senior manager at Nomura Research Institute America, outlined five drivers that define market scenarios.

The electric vehicle market and the OEMs’ electrification strategies are influenced by the LIB market expansion, which depends on government subsidies and regulations. These factors also affect the profitability and demand of recycling efforts. However, the amount of waste batteries from electric vehicles is very low, according to Fujita. Most of the recyclable batteries come from consumer products—around 97,000 tons in 2018. China and South Korea dominate the LIB recycling volume, with 69% and 19% respectively. They have more than 20 and six companies involved in recycling waste batteries. In contrast, waste batteries are not collected regularly in the EU and North America, but are exported or sold for reuse to Asian processors.

The profitability and cost structure of recycling depends on several factors, such as the automation of the process, the energy costs to run the facilities, and the regulations and options for dealing with toxic gases. Recycling batteries is not economically feasible in Europe and the US. Recyclers must pay for the used batteries. The transportation and dismantling of batteries require a lot of labour and are not automated. The extraction of metals such as nickel, cobalt, manganese, lithium, aluminium, and copper from the batteries does not benefit from economies of scale. For instance, NRI estimated that in Europe in 2020, the cost of battery recycling was $63/kWh, while the revenue from selling the recovered metals was only US$42/kWh.

Recyclers need technology and investment opportunities to expand their work, especially their capital. Recycling is a profitable business, but it requires a waste collection system and a chemical extraction process, and both need to be done on a large scale. This is a difficult task for individual recycling companies. They need to collaborate with other companies to overcome these challenges.

Each market also has a unique balance of recycling and reuse. For instance, in Japan, there is a lot of focus on battery reuse, and not as much on recycling. In China, though, battery recycling is more established and only recently have reuse companies been gaining traction.

Finally, local regulations can dictate the minimum level of recycled content in new batteries, and these types of regulations greatly impact the market. In Europe, rule-making will be necessary to make the lithium-ion battery recycling business profitable. In China, illegal recycling players are still very active, processing up to 70% of waste LIBs. Illegal players operating without compliance will hinder the development of a sustainable lithium battery recycling industry.

Process of Recycling Lithium-ion Battery

The process of recycling lithium-ion batteries is not simple, but it is important for reducing environmental pollution and recovering valuable materials. Here is a brief overview of how lithium-ion batteries are recycled:

First, the batteries are collected from various sources, such as businesses, households, or electric vehicles. They are sorted by type and chemistry, and transported to recycling facilities in a safe manner. Some batteries may need to be discharged or neutralized before transportation to prevent fire hazards.

Second, the batteries are disassembled into modules and cells by trained technicians. They use insulated tools to avoid electric shocks or short circuits. They also separate the outer packaging materials, such as steel cans or aluminium pouches, from the inner components.

Third, the cells are processed by different methods to extract valuable materials, such as lithium, nickel, cobalt, manganese, graphite, iron, copper, and aluminium. Some common methods are:

But did you know that millions of batteries end up in landfills every year, where they leak toxic chemicals and harm the environment? Yes, batteries contain harmful chemicals that can pollute the soil and water. By recycling them, you can keep these toxins out of the environment and protect your health. In fact, the market value of lithium-ion battery recycling worldwide is forecast to grow with a compound annual growth rate (CAGR) of more than 20 percent in the coming decade, reaching US$35.1 billion in 2031, according to Fortune Business Insights.

Aside from pollution, these batteries also pose social challenges, such as resource depletion, pollution, and safety hazards. Therefore, recycling lithium-ion batteries is not only a necessity, but also an opportunity to create a more sustainable and circular economy. In fact, industry sources see battery recycling as one of the top ten breakthroughs in 2023.

In this report, we will explore the current status, trends, challenges, and prospects of the lithium-ion battery recycling industry, and provide recommendations for its future development.

Battery Recycling: A Breakthrough Technology

Recycling batteries is not only a duty, but also an opportunity to create a more sustainable and circular economy. However, many people might not be aware of the benefits of recycling batteries for themselves and the planet.

Battery recycling can help reduce the environmental and social costs of battery production and disposal, such as greenhouse gas emissions, water pollution, land degradation, and human rights violations. It can increase the supply and availability of critical metals like lithium, cobalt, and nickel, which are essential for making batteries for electric vehicles, smartphones, laptops, and other devices. These metals are scarce, expensive, and geopolitically sensitive.

Remanufacturing can improve the performance and lifespan of batteries by recovering high-quality materials and preventing degradation. This can make batteries more efficient, reliable, and durable. Moreover, battery recycling can create new business opportunities and jobs in the circular economy, where waste is minimized and resources are reused. This can also foster innovation and collaboration among different stakeholders in the battery value chain.

However, there are also some challenges and limitations that need to be overcome. Battery recycling is still a complex and costly process that requires advanced technologies and methods to separate and purify the metals from the battery waste. The recovery rates and efficiencies vary depending on the type and condition of the battery.

Battery recycling is still not widely adopted or supported by consumers, manufacturers, regulators, or investors. There are many barriers and gaps that hinder the development and deployment of battery recycling, such as lack of awareness, incentives, standards, infrastructure, or policies.

Battery recycling is not a silver bullet that can solve all the problems related to battery production and consumption. There are still other aspects that need to be addressed, such as improving battery design, reducing battery demand, increasing battery reuse or refurbishment, or finding alternative materials or sources.

Drivers that Define Market Scenarios

There are a few market scenarios that influence the performance and behaviour of the lithium-ion market over time. To understand how different market scenarios might unfold in the future, it is important to identify and analyse the drivers that shape them. Akihito Fujita, a senior manager at Nomura Research Institute America, outlined five drivers that define market scenarios.

The electric vehicle market and the OEMs’ electrification strategies are influenced by the LIB market expansion, which depends on government subsidies and regulations. These factors also affect the profitability and demand of recycling efforts. However, the amount of waste batteries from electric vehicles is very low, according to Fujita. Most of the recyclable batteries come from consumer products—around 97,000 tons in 2018. China and South Korea dominate the LIB recycling volume, with 69% and 19% respectively. They have more than 20 and six companies involved in recycling waste batteries. In contrast, waste batteries are not collected regularly in the EU and North America, but are exported or sold for reuse to Asian processors.

The profitability and cost structure of recycling depends on several factors, such as the automation of the process, the energy costs to run the facilities, and the regulations and options for dealing with toxic gases. Recycling batteries is not economically feasible in Europe and the US. Recyclers must pay for the used batteries. The transportation and dismantling of batteries require a lot of labour and are not automated. The extraction of metals such as nickel, cobalt, manganese, lithium, aluminium, and copper from the batteries does not benefit from economies of scale. For instance, NRI estimated that in Europe in 2020, the cost of battery recycling was $63/kWh, while the revenue from selling the recovered metals was only US$42/kWh.

Recyclers need technology and investment opportunities to expand their work, especially their capital. Recycling is a profitable business, but it requires a waste collection system and a chemical extraction process, and both need to be done on a large scale. This is a difficult task for individual recycling companies. They need to collaborate with other companies to overcome these challenges.

Each market also has a unique balance of recycling and reuse. For instance, in Japan, there is a lot of focus on battery reuse, and not as much on recycling. In China, though, battery recycling is more established and only recently have reuse companies been gaining traction.

Finally, local regulations can dictate the minimum level of recycled content in new batteries, and these types of regulations greatly impact the market. In Europe, rule-making will be necessary to make the lithium-ion battery recycling business profitable. In China, illegal recycling players are still very active, processing up to 70% of waste LIBs. Illegal players operating without compliance will hinder the development of a sustainable lithium battery recycling industry.

Process of Recycling Lithium-ion Battery

The process of recycling lithium-ion batteries is not simple, but it is important for reducing environmental pollution and recovering valuable materials. Here is a brief overview of how lithium-ion batteries are recycled:

First, the batteries are collected from various sources, such as businesses, households, or electric vehicles. They are sorted by type and chemistry, and transported to recycling facilities in a safe manner. Some batteries may need to be discharged or neutralized before transportation to prevent fire hazards.

Second, the batteries are disassembled into modules and cells by trained technicians. They use insulated tools to avoid electric shocks or short circuits. They also separate the outer packaging materials, such as steel cans or aluminium pouches, from the inner components.

Third, the cells are processed by different methods to extract valuable materials, such as lithium, nickel, cobalt, manganese, graphite, iron, copper, and aluminium. Some common methods are:

- Pyrometallurgy: This method involves heating the cells in a furnace at high temperatures to melt the metals. The metals are then separated by their different melting points or chemical reactions. This method is energy-intensive and may produce harmful emissions.

- Hydrometallurgy: This method involves dissolving the cells in acids or other chemicals to leach out the metals. The metals are then separated by precipitation, solvent extraction, or ion exchange. This method is less energy-intensive but may produce large amounts of wastewater.

- Direct recycling: This method involves recovering the cathode materials from the cells without breaking them down into individual metals. The cathode materials are then regenerated by removing impurities or adding new materials. This method preserves the original structure and performance of the cathode materials and reduces waste generation.

Fourth, the recovered materials are refined and reused for various applications, such as making new batteries, electronics, or other products. The recycling process reduces the need for mining new minerals and conserves natural resources.

Latest Trends in Recycling Lithium-Ion Batteries

New advances in direct recycling, which is a method that involves recovering the cathode materials from the cells without breaking them down into individual metals. This method preserves the original structure and performance of the cathode materials and reduces waste generation. One example of this technique is using a eutectic mixture of lithium iodide and lithium hydroxide to dissolve and regenerate the cathode materials at low temperatures.

Increased investment and regulation in battery recycling, especially in China, Europe, and North America. These regions are leading the world in battery recycling today, with major battery companies like CATL and Umicore, as well as startups like Redwood Materials and Li-Cycle, scaling up their operations and technologies. The EU recently proposed extensive recycling regulations with mandates for battery manufacturers.

Growing demand and market potential for recycled battery materials, as electric vehicles become more common and require more lithium-ion batteries. Recycling can help reduce the environmental impact and supply risk of mining new minerals, as well as conserve natural resources. Recycling facilities can now recover nearly all of the cobalt and nickel and over 80% of the lithium from used batteries and manufacturing scrap. The global battery recycling market is expected to reach US$13 billion by 2030.

Key Market Players

There are many market players in the lithium-ion battery recycling industry, which is expected to grow rapidly in the coming years due to the increasing demand for electric vehicles, renewable energy, and consumer electronics. Some of the major players in the market are:

Umicore (Belgium): Umicore is a global materials technology and recycling group that offers a range of services for the recycling of lithium-ion batteries, such as collection, sorting, dismantling, metal extraction, refining, and reuse. Umicore has a recycling plant in Hoboken, Belgium, that can process up to 35,000 tons of batteries per year.

Li-Cycle Corp. (Canada): Li-Cycle is a clean technology company that specializes in the recovery of critical materials from end-of-life and scrap lithium-ion batteries using a patented hydrometallurgical process. Li-Cycle claims to achieve over 95% recovery of all materials from lithium-ion batteries and produce battery-grade products that can be directly used in new battery manufacturing.

Redwood Materials Inc. (US): Redwood Materials is a battery recycling and materials company founded by former Tesla CTO JB Straubel. Redwood Materials aims to create a circular supply chain for battery materials by recovering and refining metals from scrap and end-of-life batteries and supplying them back to battery manufacturers. Redwood Materials has partnered with Panasonic, Envision AESC, and Amazon to recycle their batteries.

Contemporary Amperex Technology Co., Limited (CATL) (China): CATL is one of the world’s largest producers of lithium-ion batteries for electric vehicles and energy storage systems. CATL also provides battery recycling services through its subsidiary Brunp Recycling. CATL has recycling facilities in Ningde and Tianjin, China, that can process up to 120,000 tons of batteries per year.

RecycLiCo Battery Materials Inc. (Canada): RecycLiCo is a subsidiary of American Manganese Inc., a critical metals company that focuses on the recycling of lithium-ion batteries using a patented hydrometallurgical process. RecycLiCo claims to achieve 100% recovery of cathode materials from lithium-ion batteries and produce high-purity products that can be used in new battery manufacturing.

Key Industry Developments

Fortum, a leading European energy company and a forerunner in battery recycling technology, founded Fortum Batterie Recycling GmbH in Germany to provide safe and sustainable electric vehicle (EV) battery recycling in central Europe. In March 2023, Fortum Battery Recycling started EV battery recycling operations in Kirchardt, Germany. In April, the company started operating a hydrometallurgical facility in Harjavalta, Finland that is today Europe’s largest closed-loop recycling facility.

Glencore, FCC Ámbito and Iberdrola are three companies that have announced their intention to partner to provide lithium-ion battery recycling solutions for Spain and Portugal. They aim to tackle one of the biggest challenges in the energy sector, which is the circularity of the batteries used in electric vehicles and other applications. They plan to develop a specialized facility that will allow the pre-processing of lithium-ion batteries and battery scrap, separating them into distinct streams for further downstream refining and recovery of battery metals. This initiative will contribute to the sustainability and decarbonization of the economy, as well as to the research and development of effective recycling technologies.

The U.S. Department of Energy (DOE) announced more than US$192 million in new funding for recycling batteries from consumer products, launching an advanced battery research and development (R&D) consortium, and the continuation of the Lithium-Ion Battery Recycling Prize, which began in 2019. The funding aims to support the Biden-Harris Administration’s goal of achieving a net-zero carbon economy by 2050 and creating millions of clean energy jobs.

A new technique for direct recycling of lithium-ion batteries was disclosed in the Journal of the American Chemical Society. The technique uses a eutectic mixture of lithium iodide and lithium hydroxide to dissolve and regenerate the cathode materials at low temperatures. This method preserves the original structure and performance of the cathode materials and reduces waste generation.

A critical review of the environmental impacts of different recycling routes of lithium-ion batteries was published in MRS Energy & Sustainability. The review compares the life-cycle assessment (LCA) studies of various recycling methods, such as pyrometallurgy, hydrometallurgy, and direct recycling, and evaluates their benefits for substitution, energy demand, and global warming potential. The review also identifies the key challenges and opportunities for improving recycling efficiency and sustainability.

Possible Predictions

Lithium-ion battery demand is expected to grow by 27 percent annually to reach around 4,700 GWh by 2030, reports McKinsey & Company. Battery energy storage systems (BESS) will have a CAGR of 30 percent, and the GWh required to power these applications in 2030 will be comparable to the GWh needed for all applications today.

China could account for 45 percent of total Lithium-ion demand in 2025 and 40 percent in 2030—most battery-chain segments are already mature in that country. Nevertheless, growth is expected to be highest globally in the EU and the United States, driven by recent regulatory changes, as well as a general trend toward localization of supply chains. In total, at least 120 to 150 new battery factories will need to be built between now and 2030 globally.

In line with the surging demand for Lithium-ion batteries across industries, McKinsey & Company projects that revenues along the entire value chain will increase 5-fold, from about US$85 billion in 2022 to over US$400 billion in 2030. Active materials and cell manufacturing may have the largest revenue pools. Mining is not the only option for sourcing battery materials, since recycling is also an option. Although the recycling segment is expected to be relatively small in 2030, it is projected to grow more than three-fold in the following decade, when more batteries reach their end-of-life.

Moreover, the demand for recycled battery materials, such as lithium, cobalt, nickel, and manganese, will increase as electric vehicles become more popular and require more batteries. Recycling can help reduce the environmental impact and supply risk of mining new minerals, as well as conserve natural resources.

The regulations and safety requirements for recycling lithium-ion batteries will become more stringent and harmonized across different regions, such as the EU, the US, and China. This will help ensure the compliance and responsibility of recycling stakeholders and protect the environment and human health.

The technology and investment for recycling lithium-ion batteries will improve and diversify, with new advances in direct recycling, which is a method that involves recovering the cathode materials from the cells without breaking them down into individual metals. This method preserves the original structure and performance of the cathode materials and reduces waste generation.

The balance between the reuse and recycling of lithium-ion batteries will shift, with more opportunities for reusing batteries for different applications, such as energy storage systems or power tools. This will help extend the battery lifespan, performance, and safety, as well as reduce the need for recycling.

In closing, recycling lithium-ion batteries is a vital strategy to address the growing demand for these. According to a recent study, recycled lithium-ion batteries can perform better than new ones, lasting longer and charging faster. Therefore, recycling lithium-ion batteries is not only a necessity but also an opportunity to create a more sustainable and efficient energy system. Battery manufacturers may find new opportunities in recycling as the market matures. Recycling can help them secure a stable supply of raw materials, reduce their environmental impact, and enhance their brand reputation.

Latest Trends in Recycling Lithium-Ion Batteries

New advances in direct recycling, which is a method that involves recovering the cathode materials from the cells without breaking them down into individual metals. This method preserves the original structure and performance of the cathode materials and reduces waste generation. One example of this technique is using a eutectic mixture of lithium iodide and lithium hydroxide to dissolve and regenerate the cathode materials at low temperatures.

Increased investment and regulation in battery recycling, especially in China, Europe, and North America. These regions are leading the world in battery recycling today, with major battery companies like CATL and Umicore, as well as startups like Redwood Materials and Li-Cycle, scaling up their operations and technologies. The EU recently proposed extensive recycling regulations with mandates for battery manufacturers.

Growing demand and market potential for recycled battery materials, as electric vehicles become more common and require more lithium-ion batteries. Recycling can help reduce the environmental impact and supply risk of mining new minerals, as well as conserve natural resources. Recycling facilities can now recover nearly all of the cobalt and nickel and over 80% of the lithium from used batteries and manufacturing scrap. The global battery recycling market is expected to reach US$13 billion by 2030.

Key Market Players

There are many market players in the lithium-ion battery recycling industry, which is expected to grow rapidly in the coming years due to the increasing demand for electric vehicles, renewable energy, and consumer electronics. Some of the major players in the market are:

Umicore (Belgium): Umicore is a global materials technology and recycling group that offers a range of services for the recycling of lithium-ion batteries, such as collection, sorting, dismantling, metal extraction, refining, and reuse. Umicore has a recycling plant in Hoboken, Belgium, that can process up to 35,000 tons of batteries per year.

Li-Cycle Corp. (Canada): Li-Cycle is a clean technology company that specializes in the recovery of critical materials from end-of-life and scrap lithium-ion batteries using a patented hydrometallurgical process. Li-Cycle claims to achieve over 95% recovery of all materials from lithium-ion batteries and produce battery-grade products that can be directly used in new battery manufacturing.

Redwood Materials Inc. (US): Redwood Materials is a battery recycling and materials company founded by former Tesla CTO JB Straubel. Redwood Materials aims to create a circular supply chain for battery materials by recovering and refining metals from scrap and end-of-life batteries and supplying them back to battery manufacturers. Redwood Materials has partnered with Panasonic, Envision AESC, and Amazon to recycle their batteries.

Contemporary Amperex Technology Co., Limited (CATL) (China): CATL is one of the world’s largest producers of lithium-ion batteries for electric vehicles and energy storage systems. CATL also provides battery recycling services through its subsidiary Brunp Recycling. CATL has recycling facilities in Ningde and Tianjin, China, that can process up to 120,000 tons of batteries per year.

RecycLiCo Battery Materials Inc. (Canada): RecycLiCo is a subsidiary of American Manganese Inc., a critical metals company that focuses on the recycling of lithium-ion batteries using a patented hydrometallurgical process. RecycLiCo claims to achieve 100% recovery of cathode materials from lithium-ion batteries and produce high-purity products that can be used in new battery manufacturing.

Key Industry Developments

Fortum, a leading European energy company and a forerunner in battery recycling technology, founded Fortum Batterie Recycling GmbH in Germany to provide safe and sustainable electric vehicle (EV) battery recycling in central Europe. In March 2023, Fortum Battery Recycling started EV battery recycling operations in Kirchardt, Germany. In April, the company started operating a hydrometallurgical facility in Harjavalta, Finland that is today Europe’s largest closed-loop recycling facility.

Glencore, FCC Ámbito and Iberdrola are three companies that have announced their intention to partner to provide lithium-ion battery recycling solutions for Spain and Portugal. They aim to tackle one of the biggest challenges in the energy sector, which is the circularity of the batteries used in electric vehicles and other applications. They plan to develop a specialized facility that will allow the pre-processing of lithium-ion batteries and battery scrap, separating them into distinct streams for further downstream refining and recovery of battery metals. This initiative will contribute to the sustainability and decarbonization of the economy, as well as to the research and development of effective recycling technologies.

The U.S. Department of Energy (DOE) announced more than US$192 million in new funding for recycling batteries from consumer products, launching an advanced battery research and development (R&D) consortium, and the continuation of the Lithium-Ion Battery Recycling Prize, which began in 2019. The funding aims to support the Biden-Harris Administration’s goal of achieving a net-zero carbon economy by 2050 and creating millions of clean energy jobs.

A new technique for direct recycling of lithium-ion batteries was disclosed in the Journal of the American Chemical Society. The technique uses a eutectic mixture of lithium iodide and lithium hydroxide to dissolve and regenerate the cathode materials at low temperatures. This method preserves the original structure and performance of the cathode materials and reduces waste generation.

A critical review of the environmental impacts of different recycling routes of lithium-ion batteries was published in MRS Energy & Sustainability. The review compares the life-cycle assessment (LCA) studies of various recycling methods, such as pyrometallurgy, hydrometallurgy, and direct recycling, and evaluates their benefits for substitution, energy demand, and global warming potential. The review also identifies the key challenges and opportunities for improving recycling efficiency and sustainability.

Possible Predictions

Lithium-ion battery demand is expected to grow by 27 percent annually to reach around 4,700 GWh by 2030, reports McKinsey & Company. Battery energy storage systems (BESS) will have a CAGR of 30 percent, and the GWh required to power these applications in 2030 will be comparable to the GWh needed for all applications today.

China could account for 45 percent of total Lithium-ion demand in 2025 and 40 percent in 2030—most battery-chain segments are already mature in that country. Nevertheless, growth is expected to be highest globally in the EU and the United States, driven by recent regulatory changes, as well as a general trend toward localization of supply chains. In total, at least 120 to 150 new battery factories will need to be built between now and 2030 globally.

In line with the surging demand for Lithium-ion batteries across industries, McKinsey & Company projects that revenues along the entire value chain will increase 5-fold, from about US$85 billion in 2022 to over US$400 billion in 2030. Active materials and cell manufacturing may have the largest revenue pools. Mining is not the only option for sourcing battery materials, since recycling is also an option. Although the recycling segment is expected to be relatively small in 2030, it is projected to grow more than three-fold in the following decade, when more batteries reach their end-of-life.

Moreover, the demand for recycled battery materials, such as lithium, cobalt, nickel, and manganese, will increase as electric vehicles become more popular and require more batteries. Recycling can help reduce the environmental impact and supply risk of mining new minerals, as well as conserve natural resources.

The regulations and safety requirements for recycling lithium-ion batteries will become more stringent and harmonized across different regions, such as the EU, the US, and China. This will help ensure the compliance and responsibility of recycling stakeholders and protect the environment and human health.

The technology and investment for recycling lithium-ion batteries will improve and diversify, with new advances in direct recycling, which is a method that involves recovering the cathode materials from the cells without breaking them down into individual metals. This method preserves the original structure and performance of the cathode materials and reduces waste generation.

The balance between the reuse and recycling of lithium-ion batteries will shift, with more opportunities for reusing batteries for different applications, such as energy storage systems or power tools. This will help extend the battery lifespan, performance, and safety, as well as reduce the need for recycling.

In closing, recycling lithium-ion batteries is a vital strategy to address the growing demand for these. According to a recent study, recycled lithium-ion batteries can perform better than new ones, lasting longer and charging faster. Therefore, recycling lithium-ion batteries is not only a necessity but also an opportunity to create a more sustainable and efficient energy system. Battery manufacturers may find new opportunities in recycling as the market matures. Recycling can help them secure a stable supply of raw materials, reduce their environmental impact, and enhance their brand reputation.